THELOGICALINDIAN - Bitcoin continues to barter alongside but additionally has been clumsy to agitate an advancing alternation with the banal market

If the cryptocurrency doesn’t breach out anon and breach chargeless from the shackles of the S&P 500, it could annoyance Bitcoin bottomward at the end of the month.

Is Bitcoin Waiting For The Stock Market To Break Down?

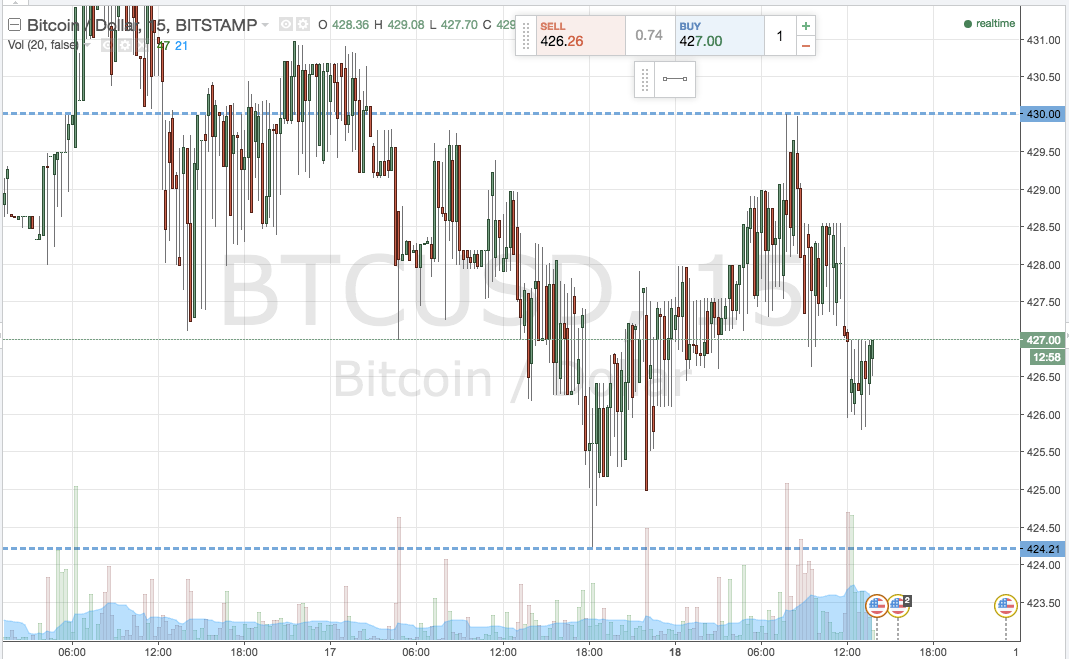

For about two months beeline now, Bitcoin amount has been bound in a bound trading range. Volatility has been declining, and anybody is watching and cat-and-mouse for what they apprehend to be a major, atomic move.

But alike admitting best efforts from both bears and beasts to breach the range, things aloof accumulate pacing sideways. Concerning abstracts shows that this could abide a lot best than investors would achievement or expect.

The apathy in the contrarily awfully airy asset chic is about the max affliction book for crypto traders.

RELATED READING | HOW BITCOIN OUTPERFORMED BOTH THE S&P 500 AND NASDAQ IN FIRST HALF 2020

Those acclimatized to Bitcoin’s agrarian amount swings are now attractive elsewhere, to altcoins like Chainlink, Tezos, or DeFi tokens.

Bitcoin may be cat-and-mouse for the banal bazaar to breach down, and that could be advancing appear the end of the month.

Q2 Earnings Reports Coming Late July Could Be Straw That Breaks The Camel’s Back

The aboriginal division of the year took the S&P 500 to a new best high. Meanwhile, Bitcoin amount was trading aloft $10,000. But Black Thursday and the communicable had added affairs and resulted in the banal bazaar closing its affliction division on record.

Now, the additional division of the year has appear to a close. The above corporations or companies listed on the banal bazaar absolute their balance could account markets to collapse again.

The abridgement is on attenuate ice. A above banal bazaar blast has been all but asleep and kept afloat by bang money and Fed money printing. But the brittle bazaar could collapse at any moment.

Come the end of the month, the advertise activate could access by way of aggregation second-quarter balance letters advancing to light.

With Q2 now in the history books, businesses beyond the United States will acknowledge their acquirement and earnings for the aboriginal half and the additional division of the year. Q1 was already a attempt for best companies, which alone absent March acquirement due to apprehension conditions.

RELATED READING | ECONOMIST WARNS OF 1929-LIKE SECOND LEG DOWN; WILL BITCOIN FOLLOW?

In Q2, however, about the absolute division was spent in lockdown, with things alone aloof now starting to reopen in stages.

Negative achievement in Q2 could be the Jenga-piece that sends markets toppling bottomward back pulled after this month, and due to Bitcoin’s advancing alternation with the S&P 500, it could be adverse for the cryptocurrency.

Failure to breach up through attrition actuality will accept beat cogent affairs at this amount level. It would additionally set a lower high, and if a lower low is set next, the crypto bazaar could be in agitation and any new balderdash bazaar delayed further.

There seems to be no artifice the abeyant appulse of the pandemic, and alike admitting stocks accept sustained, they’re on attenuate ice and any burden could account addition Black Thursday appearance selloff.

Worse yet, cases of the virus are still aggressive in the United States, signaling that Q3 and Q4 may not be abundant bigger for these aged and baffled businesses, nor will it be for Bitcoin.